Navigating the Financial Landscape in 2024

The start-up ecosystem is always evolving, and funding trends are closely tied to larger economic, technological, and social changes. But how do these factors actually influence the way entrepreneurs pursue their financial goals, especially when it comes to innovation and growth in the months ahead? In this blog, we'll dive into the key trends shaping the start-up landscape, explore the challenges and opportunities they bring, and discuss practical strategies you can use to stay ahead in this dynamic environment. Ready to explore? Let’s jump in!

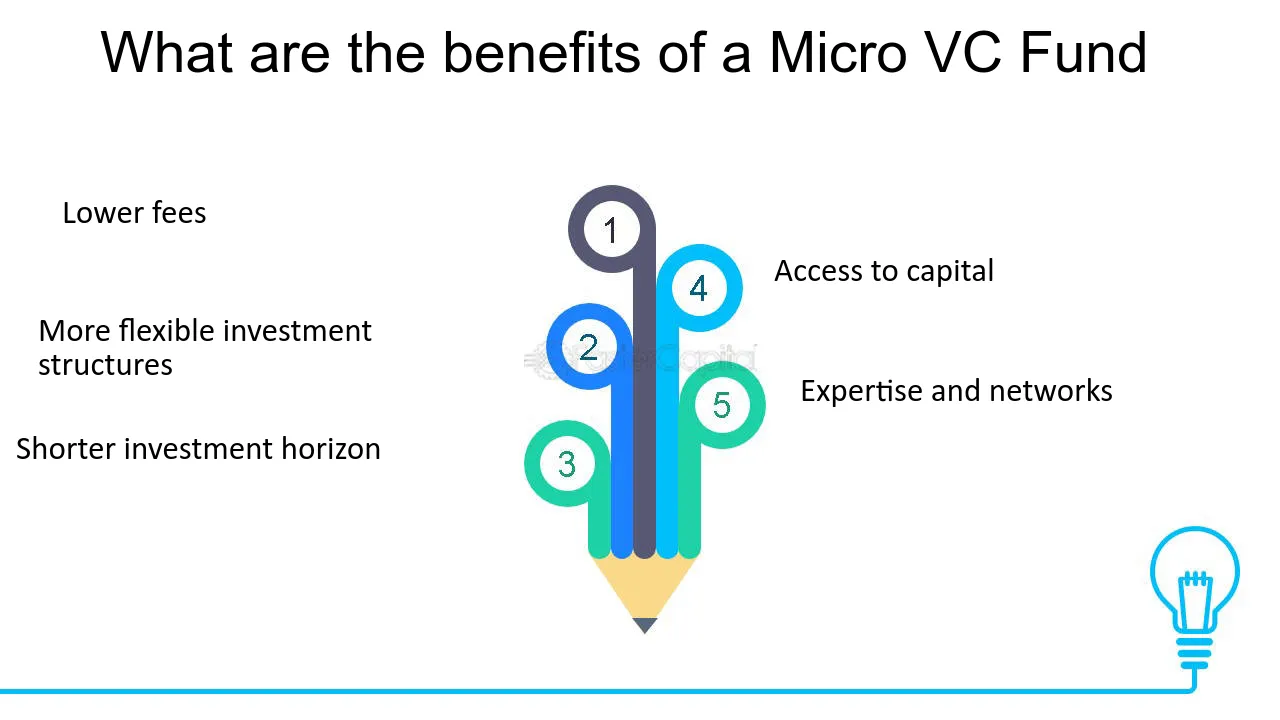

1. The Shift of Micro-VC Funds

One of the most significant trends noticed is the proliferation of micro VC funds. Generally, these funds have a smaller cheque size compared to the traditional VC funds, and they are typically considered an ideal partner for seed-stage startups.

Micro-VCs democratize access to capital, support a much more inclusive list of innovative ventures, and allow for a more diverse portfolio.

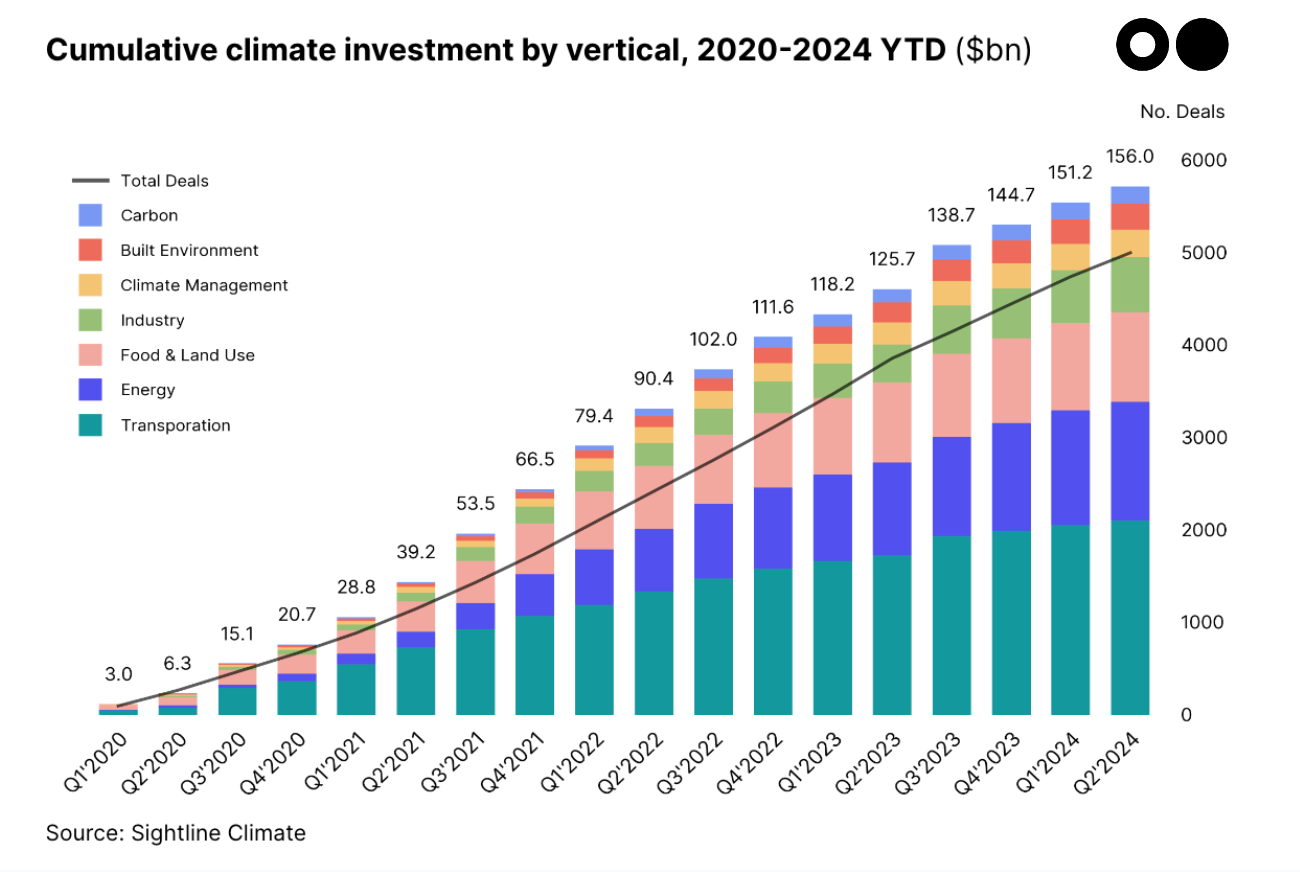

2. Shifting Towards Climate Tech

Climate tech represents a significant hot area for investors. As the urgency of the situation continues to grow with regard to the whole climate change situation, innovative start-ups focused on offering novel solutions in this space attract the highest investment. Investment into climate tech became history in 2023, and this is expected to be the case in 2024.

3. Funding Diversity and Inclusion

Investors have realized that diversity and inclusion

truly matter in the start-up ecosystem. There

has been a steady increase in investment into female-founded ventures,

start-ups by underrepresented founders, and ventures focused on social or

environmental causes. Equity is no longer the only beneficiary; change forces

innovation, pushing diverse perspectives to the center.

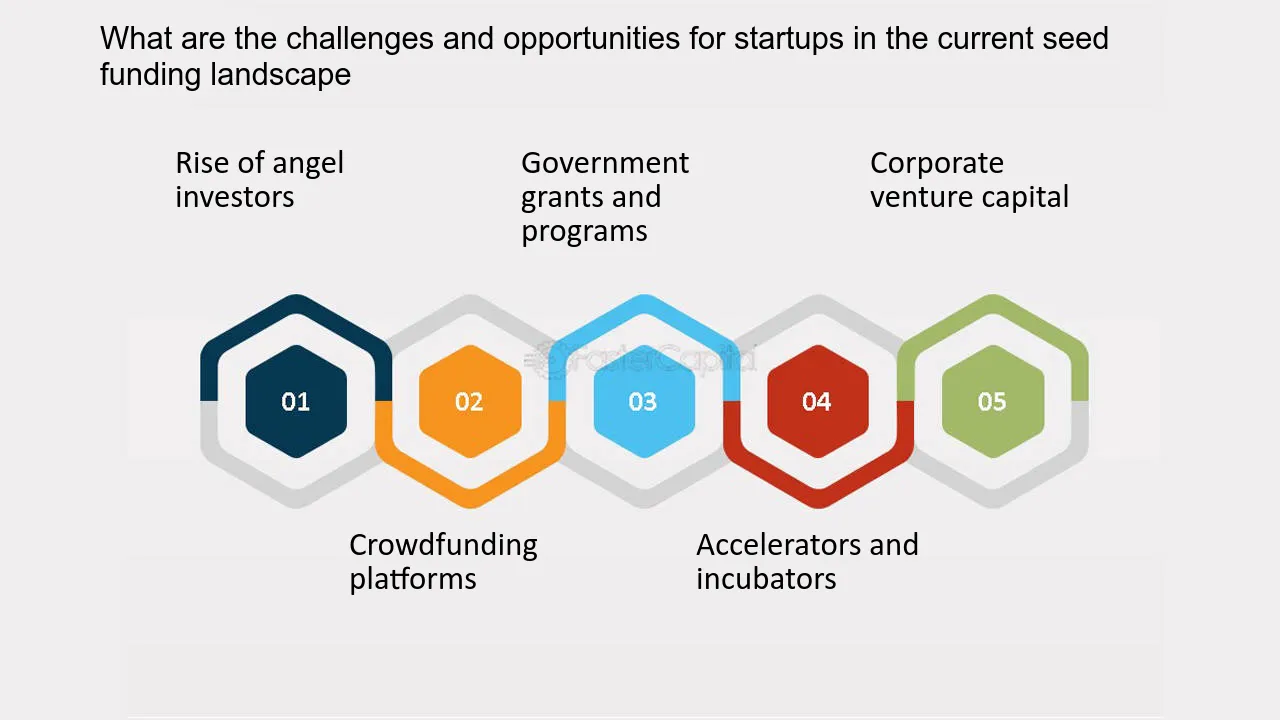

4. Emergence of Alternative Funding Sources

For

a long time, venture capital funding was the only trend in town. Now, alternate

sources of funding in the forms of crowdfunding, Initial Coin Offerings (ICOs),

and debt financing are gaining their popularity. They offer much more

flexibility to start-ups and will become useful particularly for those who

don't fit into the mould of a typical VC investment.

5.

Investment Trends Sector Specific

The sectors that are also gaining the most traction include healthcare, clean energy, and biotech. Once more, this testifies to the aspects society is focusing on, especially the pressing need for change in these sectors.

Challenges in the Current Funding Landscape

Yet, with these trends, it is never without challenge. Economic uncertainty, geopolitical tensions, and rising interest rates have slowed down venture capital funding on the global platform. This trend is compelling entrepreneurs and investors to be more review-oriented with strategies and changes.

Indian start-ups raised about $24 billion in 2023, marking a slight decline from the previous year due to macroeconomic factors but still reflecting strong investor interest in key sectors like fintech, health tech, and climate tech.

Conclusion

Startup funding is changing—and it’s exciting! Investors are now prioritizing innovation and impact, with a growing focus on startups that tackle big challenges like sustainability. Traditional funding is still around, but crowdfunding and angel investing are opening doors for more entrepreneurs to access capital.

Want to stand out? Stay agile, align with the growing focus on sustainability, and tap into these fresh funding options. The future of startup funding isn’t just about money—it’s about creating something meaningful.

Funding Trends in Start-Ups